Is It Best To Get Finance Or Pay Cash For My Car Purchase?

Saving up to buy a car can seem like it takes forever. 😚 But if you find yourself in a position where you have savings in place, buying a vehicle using cash may seem like the best option. Ultimately, it all comes down to your financial situation and what’s right for you: buying outright with cash or getting car finance.

Savings are an emergency fund for many, and it may not make sense to use all of your reserves for a car, no matter how lovely it is. Besides, there are circumstances where taking a loan or finance is the better option.

So what is the best way to pay for a car? Which one is best for your needs in the car purchase with cash vs finance debate? That’s what we’re here to find out with this guide to whether you should finance your car or pay for it outright.

Car Finance Vs. Paying Cash

Car finance options involve taking a loan from a bank, credit union or dealership financing. You borrow the money directly and are expected to pay it back monthly within a set period, typically between one to five years – although longer options (such as seven years) are available.

Dealership financing usually comes in the form of personal contract purchase (PCP) or hire purchase (HP) and requires a deposit, usually 10% or more. With most forms of car financing, buyers are charged a set interest rate. This rate depends on your credit rating and loan term length.

On the other hand, paying with cash involves buying the car outright. You don’t finance the car and instead pay for it all in one go, usually with money from your own pocket. This method is often seen as the preferable option because it doesn’t leave you with any debt to pay. Plus, you don’t pay interest to a third party.

Cash sounds great, right? It does, but not every buyer has several thousand of pounds to splurge on a car. In fact, we’d go as far as to say that most consumers don’t feel comfortable spending large sums of money on a car upfront, especially on a used car.

So, that must mean that car financing rules when it comes to buying a used car, right? Before we get too ahead of ourselves, let’s take a closer look at the benefits and disadvantages of both.

Pros Of Buying A Car With Cash

There’s no interest

Since you don’t take any form of loan, there’s no need to pay any interest. You buy and own the car outright with just a one-off payment.

Interest charges on a bank loan can be high and are an added expense on your monthly budget. When factoring in the total cost of finance, you need to consider the interest rate, which forms part of the APRC. Therefore, if you can avoid this extra cost, paying cash is a cheaper way of buying a car.

Good For Budgeting

Your budget and costs aren’t affected by monthly payments. So when it comes to finance or cash for a used car, the latter means there’s no need to worry about money coming out of your bank account every month. There’s only one payment to cover, which is the upfront cost of the car.

Car Ownership

Purchasing a car using cash means you own the vehicle outright. No ifs or buts – the car is 100% yours.

Safe Credit Score

Since you are not taking a loan, there is no impact on your credit history. Plus, your credit score isn’t important and won’t affect your car purchase. Because you’re paying with cash, there’s no need to rely on a credit report to get finance. Technically, you don’t even need a credit score to buy a car with cash.

Cons Of Buying A Car With Cash

Depreciating Asset

A car is an expensive item, and in most cases, it depreciates really fast. Did you know that most vehicles lose about 10% of their value the moment they’re driven off the dealership? Unless you have an all-time classic, it’s safe to assume that buying a car is not a financial investment where your capital appreciates over time.

No Emergency Fund

Most car buyers who use cash to buy vehicles in the UK tap into their savings. In the event you run into a financial emergency, you might not have the money to fall back on. This may not be the most sensible way to pay for a car if it will leave you without any money left.

You lose investment opportunities

Most people save up to invest. With a car, you’re essentially losing your opportunity to invest your savings in something that will increase in value over the long term. Whether it’s stocks, bonds or property, good investments yield higher returns. That’s not the case when you buy a car with cash.

You could be limited by what you can buy

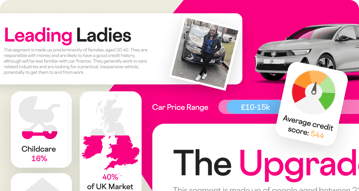

Unless you’re sitting in some sort of endless money pit, you may face restrictions when buying a car with cash. Cars are expensive, especially sought-after ones like the best BMW cars and Mercedes. It’s not uncommon for one of these cars to cost £30k brand new and even £10-15k used. So if you’re after something a little flashier, you’ll likely have to stump up a significant amount of cash upfront.

Pros Of Car Finance

Credit Score Boost

Buying a car with finance from your dealership or bank improves your credit rating. Regular monthly payments paid on time will help build your credit score and could see you qualify for better loan deals in the future.

More Car Options

Again, a cash payment ties down your choice of car. With car financing, you can spread the cost, which means your budget will likely be higher and you can go and treat yourself to the 1 Series you’ve had your eye on for a while now. Thanks to the payments being spread out, your financial commitment isn’t all at once, and you can pay a lower amount each month.

Fixed Monthly Payments

If your credit score is really good, it may be better to buy a car using finance. People with high credit scores are eligible for financing with low-interest rates and lower fixed monthly payments.

Cons Of Car Finance

Interest Payments

In comparison to cash, car finance has an interest rate charged on loans. This interest charge forms part of your monthly repayments. That means you need to pay back the amount borrowed plus any additional interest.

Car Ownership

With car finance, you don't fully own the car, nor can you make any alterations to the vehicle. The dealership can set extra charges on mileage limits and damages, too, though they must specify this before you sign a contract. It’s a bit like owning a house with a mortgage – it’s technically yours, but only if you keep up with the monthly payments. If you default on the loan, the lender can repossess the car immediately.

Should I use finance or cash for used cars and new vehicles?

Purchasing a car is a big decision, regardless of the payment method. When looking at cash vs finance, you need to consider the financial situation and how easily you can sustain the repayments. And don't forget to factor in the other associated running costs of the vehicle, such as fuel, insurance, car tax, servicing and repairs etc.

If you can comfortably afford to pay the full amount of the car purchase in a lump sum and still keep a reserve of cash, then go for it. However, if you don't have tons of cash readily available, car finance could be a helpful option.

To apply for car finance, check out Carmoola! The efficient application process is within the App and is simple and straightforward to complete. And you'll have your decision within minutes! 😄