HP vs PCP is the big debate in car finance. They’re two of the most popular ways to spread the cost of buying a new or used car and have many...

Our first 1,000 customers will be driving off happy with an awesome Carmoola swag box 😎

Our first 1,000 customers will be driving off happy with an awesome Carmoola swag box 😎

Take control of your car finance with flexible monthly payments to suit you.

Takes 60 seconds, no impact on your credit profile to see if you're approved 👍

Representative 14.8% APR

Car finance is simply a credit agreement between you and a lender. This agreement lets you pay for a car in monthly instalments. This means that you can borrow money from a lender to pay for the car and then repay the amount borrowed with interest to the finance company.

The total amount you repay will depend on four factors - how much the car costs, the length of the term you decide on, the size of your deposit and the interest rate you’re offered by the lender.

Step 1

In just 60 seconds, see how much you can borrow towards your next car

Step 2

Pay swiftly online with your card, or by bank transfer at the showroom

Step 3

It's time to plan your next adventure in your shiny new ride

We offer hire purchase loans between £2k-40k for used cars.

Finance is subject to status and is only available to UK residents aged 18 and over.

There are a variety of different types of car finance available, ranging in flexibility, so it’s important to consider all of the options available to help tailor the right finance package for you.

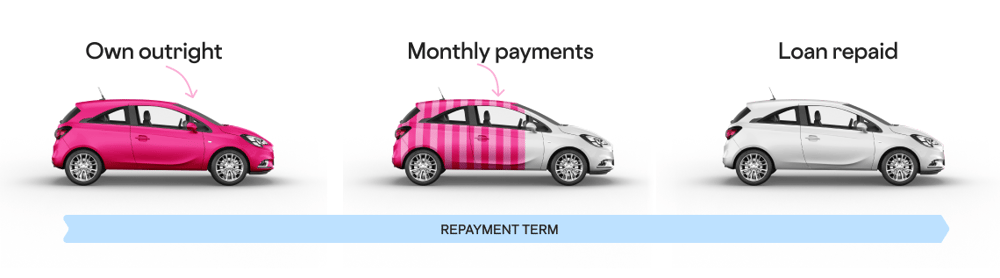

HP is a straightforward car finance product that can help spread the cost of your car by making monthly payments over an agreed term. You have the option to either pay a deposit upfront (which can be cash, trading in your old car or a mix of both) or add it to the repayment amount. You then agree on fixed monthly instalments and after the final payment you will own the car outright.

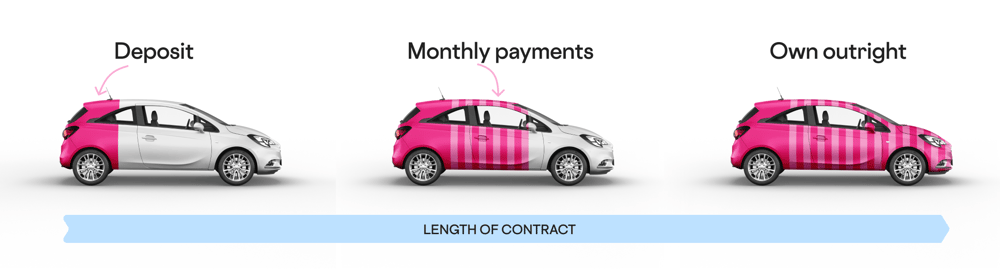

PCP is a flexible car finance product that (after you pay a deposit amount) allows you to make affordable monthly payments over an agreed contract length, with a larger (optional) final ‘balloon’ payment due at the end. A balloon payment is only due if you want to buy the car outright. You can also part exchange your car at the end of the term, or simply give it back to the lender.

A personal loan is an option that can work well for customers with a higher credit rating. These loans are often unsecured, and may be available through your bank. When applying for a personal loan, you don't need to share details about the car you're buying. You'll simply get a finance offer from your bank based on what they believe you can afford to borrow, and comfortably repay.

If you're thinking about getting car finance, it's good to get an idea of how much you might be able to borrow, and what that would cost each month. We've created a handy car finance calculator where you can play around with your monthly loan payments, loan amount, and contract length.

|

Hire Purchase (HP) |

Personal Contract Purchase (PCP) |

Personal Loan |

|

|

No deposit required |

|

|

|

|

Car is yours at the end of the agreement |

|

Optional |

|

|

Fixed monthly payments |

|

|

|

|

No (final) balloon payment A large lump sum payment which is deferred to the end of a finance agreement.

|

|

|

|

|

No excess mileage charges No mileage restrictions, so you

can drive freely without incurring additional fees. |

|

|

|

|

Secured against |

|

|

|

|

Available on Carmoola |

|

|

Answer a couple of questions to find out if you might be eligible to buy your car with Carmoola!

HP vs PCP is the big debate in car finance. They’re two of the most popular ways to spread the cost of buying a new or used car and have many...

Considering financing a car with a Hire Purchase (HP) agreement? Check out our guide to all things HP to help you decide whether it’s the right...

Considering PCP finance? If you’re weighing up your car finance options and keen to understand whether PCP is the best choice for you, you’ll need to...

Here are some of the most frequently asked questions about car finance. Got more questions? Try our FAQs page 👍

Credit score is not the only factor that determines whether you can get car finance or not. We'll also review your affordability, run fraud checks, and need to see your full driving licence. The best thing to do is start an application to understand how much you may be able to borrow, where we'll only run a soft credit search. A soft credit search doesn't impact your credit score at all, so you've got nothing to lose!

When you start your application, we'll review your income and expenditure, and let you know how much you can borrow. With Carmoola, we'll provide you a range of how much you can borrow between £2,000 to a maximum of £40,000. You've then got the flexibility to choose the exact amount depending on what's right for you.

Yes. With car finance, the interest rate is fixed throughout the agreement, so your monthly payments won't change.

No. If you're looking for Hire Purchase car finance then there will always be some interest to pay. Typical interest rates range from 6.9% to 24.9%.

Not with Carmoola! When you take car finance with Carmoola there are no mileage restrictions.

What would you like to do first?

Takes 60 seconds, no impact on your credit profile to see if you're approved 👍

Rates from as low as 6.9% APR, Representative 14.8% APR

Carmoola is a trading name of Carmoola Limited which is registered in England & Wales, under Registered No. 12992987. Its Registered Office is First Floor, 1 Whittlebury Mews West, Primrose Hill, London, NW1 8HS. Carmoola Limited is authorised and regulated by the Financial Conduct Authority (Firm Reference Number: 958057), and a member of CIFAS (the UK’s leading fraud prevention service).

Registered with the Information Commissioner’s Office in compliance with the Data Protection Regulations 2018 under registration ZA905089.

Finance is subject to status and is only available to UK residents aged 18 and over. Carmoola is committed to responsible lending.

To get in touch, email us at support@carmoola.co.uk

If you are struggling with, or worried about debt, MoneyHelper provide free support.

Copyright © Carmoola All Rights Reserved