Car finance eligibility checker

See if you’re eligible for a car loan - it's fast, free and has no impact on your credit score.

Check My EligibilityWe only carry out a full credit check after you've signed your agreements and are ready to buy the car.

Representative 13.9% APR

How it works 🤔

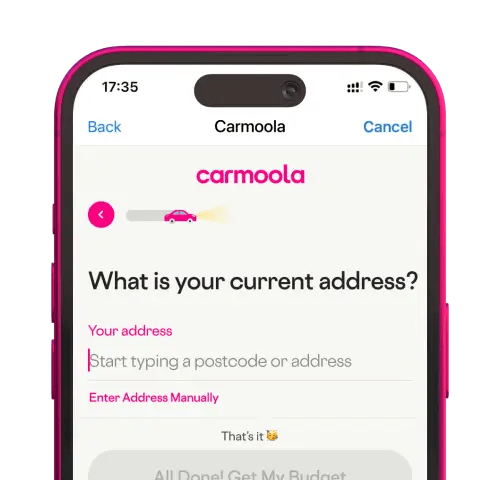

STEP 1

Tell us about you

Enter a few details like your name and address to get started

STEP 2

Find out if you’re eligible

We run a soft credit check and you can find out whether you’re eligible within 60 seconds

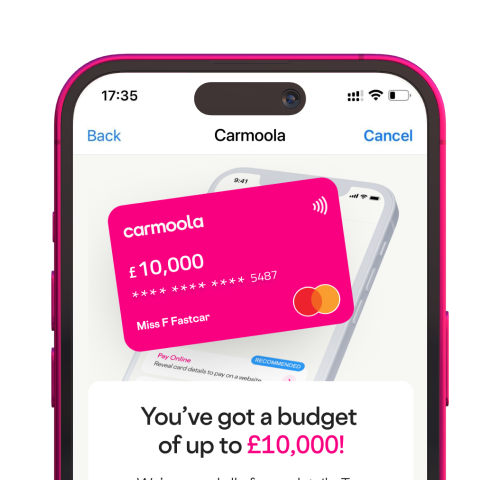

STEP 3

Get a pre-approved budget

We will tell you how much you can borrow and your personal APR, tailored to your credit score

Eligibility and pre-approval are subject to further checks when you complete a full application through the Carmoola mobile app. We offer hire purchase and personal contract purchase loans between £2k-55k for used cars.

What our customers are saying

“Such a simple way to get car finance and at a good rate too. Easy to use app with step by step process. Love the finance calculator, which allows you to adjust the amounts and see the payments instantly. Would definitely recommend!”

Simon.

“Easy to use and to get a budget with their online calculator! The best part is the flexibility, you can choose how much within your allocated budget and for how long to repay. Will defo use again in the future. *****”

Dean

“Absolutely amazing service, super quick to respond and it couldn’t have been easier, I would 100% recommend Carmoola to anyone!”

Joanne

“Not just a normal car Finance company!! Very fast and efficient and they make you feel like a valued family member, lots of unexpected after sales benefits that have been very much welcomed and appreciated too!!”

Burrow

“Incredible experience! Omg! The way forward in car finance. I’d use these guys again and thoroughly recommend them. 🚘”

Richard

What details do I need to provide?

To help the eligibility checker work its magic, you’ll need to enter a few details (don’t worry, we’ll take good care of them).

- Your full name

- Your date of birth

- Your address

- Your employment status

- Your monthly income after tax

- Any childcare or commuting costs

FAQs about checking eligibility

Here are some of the most frequently asked questions about car finance. Got more questions? Try our FAQs page 👍

Will this affect my credit score?

Will this affect my credit score?

In order to let you know your eligibility, Carmoola will need to conduct a soft credit check. This won’t be visible to lenders and won’t affect your credit score. If you continue with a full application, a full credit check will be conducted only upon signing the agreement, which may impact your credit profile.

Why do you need my personal details?

Why do you need my personal details?

We need to ask for a few personal details so we can run a soft credit check and make sure you match our eligibility criteria.

You can read more about how we process your personal information in our Privacy Policy.

What is an annual percentage rate (APR)?

What is an annual percentage rate (APR)?

Annual percentage rate - APR for short - represents the amount you’ll need to pay each year on your loan. This includes the interest due as well as any extra charges and admin costs. It’s usually shown as a percentage and is a handy way to compare different loans when weighing up your options.

What is a personal APR?

What is a personal APR?

A personal or exact APR is the rate you’ll likely receive based on your individual circumstances and credit score as well as your preferred loan amount and term length.

How are the eligibility checker results shown?

How are the eligibility checker results shown?

There’s no need to keep refreshing your inbox or waiting for the post to arrive, you’ll receive your result on your laptop or phone screen just minutes after you’ve submitted all your details. We’ll send you an email too, just in case.

Who can use this service?

Who can use this service?

Anyone aged over 18 with a full driving licence and at least three years’ address history in the UK is free to use the eligibility checker.

What does pre-approved mean?

What does pre-approved mean?

Your pre-approved budget is the amount we will be able to lend to you once we've verified all your information! This figure is subject to further checks and doesn't mean you're guaranteed to be accepted.

Takes 60 seconds, no impact on your credit profile to see if you're approved 👍

Rates from as low as 6.9% APR, Representative 13.9% APR

.webp?width=832&height=592&name=customer-support%20(1).webp)

.webp?width=400&height=285&name=online-shoppers-with-dog%20(1).webp)

.jpg?width=500&height=356&name=Vintage%20car%20going%20to%20an%20old%20town-1%20(1).jpg)