Hire Purchase

(HP) finance

Hire Purchase (HP) lets you spread the cost of your next car with fixed monthly payments and own it outright at the end.

Takes 60 seconds, no impact on your

credit profile to see if you're approved 👍

Rates from as low as 6.9% APR, Representative 13.9% APR

What is HP finance?

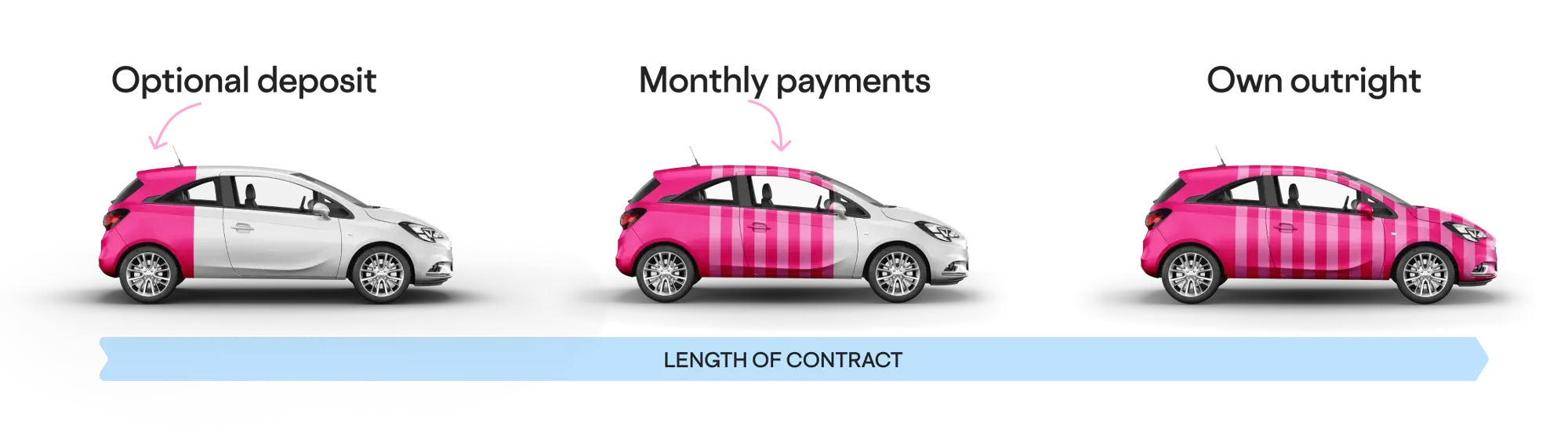

Hire Purchase – or HP – is a type of car finance that lets you spread the cost of a car over an agreed length of time, typically 1 to 5 years. Over that time you’ll make regular fixed monthly payments, including interest to pay off the loan amount.

How does Hire Purchase work?

A Hire Purchase agreement gives you the option to put down a deposit and then repay the remaining balance back in regular monthly installments. It’s as easy as 1, 2,3, Doh-Re-Mi, A, B, C, you get the gist.

Compare HP, PCP and personal loans

|

Hire Purchase (HP) |

Personal Contract Purchase (PCP) |

Personal Loan |

|

|---|---|---|---|

|

No deposit required |

|

|

|

|

Car is yours at the end of the agreement |

|

Optional |

|

|

Fixed monthly payments |

|

|

|

|

No (final) balloon payment |

|

|

|

|

No excess mileage charges |

|

|

|

|

Secured against |

|

|

|

|

Available on Carmoola |

|

|

|

This table shows common agreement features. Check with the lender for specific terms.

Can I get HP car finance?

You can apply for HP (Hire Purchase) car finance if you meet the basic eligibility criteria. Most lenders will look at a few key things, including:

Your credit history

Your income and affordability

Proof of identity and address

At least 18 or over

Your Hire Purchase journey start to finish

To apply for a Hire Purchase (HP) agreement, all you need is our app and a full driving licence. We’ll ask for some personal details to check your eligibility through a soft credit check – don’t worry, it won’t affect your credit score.

How does HP work at the end?

When you reach the end of your HP agreement, and after paying a small £1 Option to Purchase fee, you’ll become the car’s legal owner. From there, you’re free to keep the car, sell it, modify it, or trade it in – the choice is yours.

An example of how your HP payments could look like

Example: Borrowing £10,000 over 54 months with a representative APR of 13.9% and a £0 deposit.

The amount payable would be £246 per month, with a total cost of credit of £3,284 and a total amount payable of £13,285, including a one-off Option to Purchase fee of £1.

Carmoola provides car finance directly as a lender. In cases where we can’t offer finance ourselves, we may act as a credit broker.

What are the pros and cons of HP finance?

Benefits

- Tailored payments: Choose a repayment term that works for you between 1 and 5 years, though be aware of increased interest for longer terms.

- Low upfront cost: Start with a low or no deposit, making it easier to get started.

- Predictable payments: Lock in a fixed interest rate for the entire term, giving you complete control over your monthly expenses.

- Accessible option: Even with a not-so-perfect credit score, HP car finance can be easier to secure than unsecured loans thanks to the car acting as collateral.

- Own the car outright: You become the car's owner once you complete all payments

Drawbacks

- Not your wheels yet: You won’t own the car until you’ve made all the repayments.

- Modifications on hold: You can’t sell or modify the car during the loan term.

- Paying a bit more: Your monthly payments can be higher than other types of finance.

- Secured against the car: The loan is secured against the car, which means if you don't keep up with your payments, the car may be repossessed.

Am I eligible for HP car finance?

Rates from as low as 6.9% APR,

Representative 13.9% APR

How it works

How it works

No sales calls or lengthy paperwork. You only need our app, and a full driving licence.

See how much you can borrow

In just 60 seconds, see how much you can borrow towards your next car

Unlimited free car checks

Find your dream car, and make sure it’s shipshape. Usually £9.99 per check!

Buy your dream car

Add your Carmoola card to your wallet and tap to pay at the dealership

Give your car a name

Make it official – name your car and start your adventure with Carmoola

We offer hire purchase loans between £2k-40k for used cars. Finance is

subject to status and is only available to UK residents aged 18 and over.

Representative 13.9% APR

Still searching for your dream ride?

Browse thousands of cars from approved dealerships, and see your budget in seconds.

Let’s find my carWhy our

customers keep coming back 👋

I’m loving my new car life 🚗

Angelina Range Rover Evoque

Amazing efficiency and a professional way of financing. The paperless system is the top notch.

Biliat Range Rover Evoque

I bought my very own first car using Carmoola. They helped me out so much with the whole process.

Bethany Fiat 500

Easy to join. Thanks Carmoola, my dream has come true.

HoJing Toyota GT86

Carmoola is just the best, everything happened in minutes and their staff are simply the best. They made my experience perfect.

Kudzanai DS 3

Need help choosing car finance?

Hire purchase or leasing: which one is right for me?

If you're considering car finance options, you've likely come across Hire Purchase (HP) and leasing. Both are popular choices and...

2 Min ReadPCP vs HP car finance: what's the difference and which is better?

When you're choosing between a PCP or HP car finance, the decision often depends on whether you prefer lower monthly payments or...

8 Min ReadWhat is hire purchase (HP) finance?

Hire Purchase (HP for short) is a popular type of car finance that lets you spread the cost of a new or used car into monthly...

9 Min Read

Our HP finance FAQs

Here are the most frequently asked questions about how Hire Purchase works.

Got more questions? Head over to our FAQs page 👍

What details do I need to apply for Hire Purchase finance?

To get started, all you’ll need is to fill in a short form or complete a few questions using our handy app.

We’ll ask you to share a few personal details so we can check your eligibility – this will involve a soft credit check but don’t worry, it won’t affect your credit score.

We’ll need you to tell us:

- Your full name

- Your date of birth

- Your current address and how long you’ve lived there

- Your employment status

- Your income before tax

How much you’d like to borrow

To take things to the next step and complete your application, we’ll also need a few documents:

- Proof of ID – this can be a full UK driving licence

- Proof of income – such as bank statements

Can I pay off HP finance early?

To pay off HP finance early, you’ll need to get a settlement figure. You can ask the lender for this at any time. They’ll give you a figure that represents the amount you’ll need to pay to end the loan early, which usually includes the remaining payments minus any interest you’ll no longer need to pay. An early settlement charge might also apply.

Once you’ve settled up, you’ll become the car’s official owner.

Do you own the car after HP finance?

When you reach the end of your HP finance agreement, you’ll typically need to pay an Option to Purchase fee. This is a small amount that covers the admin costs associated with transferring car ownership over to you.

Once all your monthly payments and this final fee have been paid, you’ll be the car’s legal owner.

What happens if you have an accident on HP finance?

Accidents come in all shapes and sizes. If you’ve just scratched the bumper or scraped your car's paintwork, you’ll be responsible for paying for it being repaired at your local mechanic.

If your accident was more serious and you ended up with a write-off, what happens next depends on your insurance. You should receive a payment that reflects the current value of the car, and you can use this to pay the finance company and settle the outstanding finance. The insurance payment might cover the full amount or leave a shortfall, and you’ll need to pay the difference either outright or with a new loan.

Does applying for HP finance affect your credit score?

When you apply for HP finance and get past the initial eligibility stage, the lender will likely run a hard credit check to make sure the loan is the right fit for you.

This check will be visible on your credit report, and it could negatively impact your score if you have too many hard searches in a short time.

Once the finance is approved, your credit score will dip because you’re increasing the amount of debt you have. The good news is that this should only be temporary; once you start making payments, your credit score will recover. However, if you fall behind with payments, your credit score might be damaged.

Can I sell a Hire Purchase car?

You won’t become the car’s owner in an HP deal until your loan term ends and you’ve paid the Option to Purchase fee.

This means you can’t sell the car midway through your agreement – put simply, it’s not yours to sell!

If you do want to change cars early, you’ll need to settle your finance first before you can put the car up for sale or offer it as a part-exchange.

What if I can’t afford my Hire Purchase payments?

If you’re struggling with your finances and falling behind with your Hire Purchase payments, you could be at risk of having the car repossessed. Your credit score could also take a hit if you make a late payment or miss it completely.

It’s best to speak to the lender before you get to this point as they may be able to adjust the terms of your loan to help you get back on track. You might also qualify for a refinance loan with a longer loan term that could reduce your monthly repayment amount (although you’ll likely pay back more in interest overall).

Outstanding help and support

Got a question? Our friendly, UK-based team is here from

8am - 9pm EVERY day, via WhatsApp, email, SMS or phone.

.webp?width=832&height=592&name=customer-support%20(1).webp)

.webp?width=400&height=285&name=online-shoppers-with-dog%20(1).webp)

.jpg?width=500&height=356&name=Vintage%20car%20going%20to%20an%20old%20town-1%20(1).jpg)