- Carmoola

- Blog

- Car Finance

- How does car finance work?

- 🗞 Car Finance

- Last updated: Feb 11, 2022

- 11 Min Read

How does car finance work?

Written by

Verified by

See how much you can borrow in 60 seconds

| Representative Example | |

|---|---|

| Loan amount | £10,000 |

| Interest rate | 13.9% APR |

| 54 payments of | £246 |

| Total cost of credit | £3,284 |

| Option to purchase fee | £1 |

| Total payable | £13,285 |

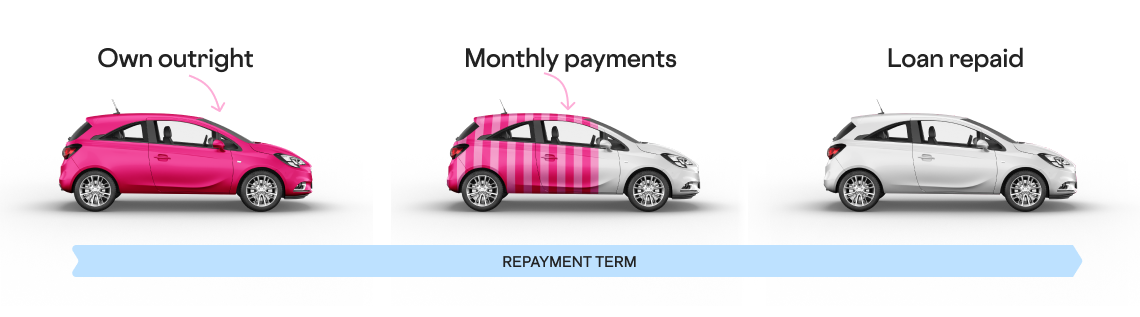

In a nutshell, car finance is when you borrow money from a lender to buy a new or used car. You usually put down a deposit and then make monthly payments to repay the money, with interest, over a fixed amount of time. Think of it like a mini mortgage for buying a car.

A car finance agreement typically lasts between one and six years. At the end of this time, you might have the option to own the car outright, or swap it for a new one, or hand it back and walk away, depending on what type of car finance you’ve got.

What are the different types of car finance?

Car finance is an umbrella term that covers a few different types of borrowing. Here’s how they work:

Personal Contract Purchase (PCP)

You pay a deposit upfront, then make fixed monthly repayments for a set period. At the end, you can make a big one-off payment (called a balloon payment) to own the car, or you can hand it back, or you can use any positive equity you’ve built up as a deposit on another car. Personal Contract Purchase is great if you like to change your car every few years, and you’re not bothered about owning the car.

Hire Purchase (HP)

Like PCP, you pay a deposit followed by fixed monthly payments. At the end of the term, you can pay a one-off Option To Purchase fee (usually £100 - £200, but just £1 with Carmoola) to become the legal owner. Hire Purchase tends to be a good option if you’re happy to commit to a car for a longer time.

Personal Contract Hire (PCH)

Also known as leasing, PCH is like a long-term car rental. You put down a deposit, then make monthly payments for two to four years. You have to stick to annual mileage limits, and keep the car in good condition, otherwise you’ll have to pay extra fees. At the end of the agreement you hand it back to the lease company - there isn’t usually an option to own the car.

Personal loan

You borrow money from a lender, use the money to pay for the car, then repay the loan over a fixed term. Personal loans aren’t secured against the car, so you’re the legal owner from day one, and you’re free to do whatever you like with it - upgrades, long road trips, you name it. But, unsecured loans are more risky for the lender, so you’ll need a good credit score and a strong payment history.

Car subscriptions

A bit like leasing, but without the long term commitment. You typically pay a fixed monthly fee for a flexible month-by-month subscription. Car subscriptions are often only available on brand new cars, and tend to be more expensive than longer term leases. But, all the incidental costs are included so the only extra you have to pay for is fuel. It’s an ideal option if you want access to a car without a long-term commitment.

How much will finance cost me?

Well, that depends. Lots of things influence the cost of your car finance, including:

Loan amount

The amount your car is worth is one of the biggest things that influences your car finance repayments. The more the car is worth, the more you’ll pay each month.

Interest rate

The interest rate on your loan has a big impact on how much you’ll pay, both monthly and overall. You’ve got a better chance of being offered a lower interest rate if your credit score is in good shape.

Loan length

A longer term for your loan usually means lower monthly payments, but can add up to repaying more overall, because you’ll pay more in interest. A shorter term tends to come with higher monthly payments, but you’ll pay less in interest.

Extra fees

You might have to pay extra charges in a PCP or PCH agreement if the car is damaged beyond fair wear and tear when you return it, or if you’ve gone over the agreed annual mileage limit.

What is the best option for me?

There’s no right or wrong - the best car finance option for you will be the one that fits your budget, circumstances and preferences. To help you decide on the best option, ask yourself.

How are your finances looking?

Think about how much you can afford to repay each month - longer term agreements usually come with lower repayments, but could cost you more overall.

Do you have a deposit available?

Most car finance agreements tend to ask you for a deposit upfront - usually around 10% of the car’s value - but if you don’t have this kind of cash lying around, there are no-deposit deals available too. Borrowing money with a personal loan doesn’t need a deposit either, so this could be an option for you.

How’s your credit score?

If your credit score’s in good shape, and you don’t have a history of missing payments, you could get a good deal on an unsecured loan, like a personal loan. On the other hand, if you need to work on your score, you might be better off with a secured loan like PCP or HP.

Do you want a new or used car?

Car subscriptions and PCH deals are usually only available on brand new cars, whereas you can use HP, PCP and a loan to buy a new or used car. If you like to switch things up and change your car regularly, PCP or a subscription might suit you. On the other hand, if you’re happy keeping the same car for a longer time, you could consider HP, a loan, or a lease.

Do you want to own the car?

If you dream of being your car’s legal owner, then PCH or subscriptions probably aren’t for you, as you’ll have to hand the car back at the end of the agreement.

How do you drive?

Long distance commuter who racks up a lot of mileage? You probably won’t want a finance agreement that comes with an annual mileage limit, like PCH or PCP. If you only use your car to pop to the shops or pootle around locally, a mileage limit might be easy to stick to.

What are the pros and cons?

Like anything money-related, it’s super important to consider the pros and cons of a car finance agreement before you jump in and sign on the dotted line. Every deal is different, but here are the general benefits and drawbacks to weigh up:

Pros

- Car finance can make it more affordable to drive newer cars

- You may have more choice of cars within your budget

- If you like to change your car more regularly, some finance options will let you do this

Cons

- You could end up in negative equity, where the amount you own on the loan is more than the car’s worth

- You might have to pay extra charges if the car is damaged, or if you go over the mileage limit

- Car finance is a legally binding contract, and a big commitment - make sure you understand what you’re agreeing to before you go for it

FAQs about how car finance works

How does the application work?

How does the application work?

You’d normally apply for car finance online. You’ll need to provide:

- Your personal details – like your name and date of birth

- Your address – including previous address history for up to three years

- Your employment status – including your income and job title

- How much you’d like to borrow – this can be an estimate if you’ve not found a car

The lender will usually carry out a soft credit check when they review whether or not they can give you a quote, but this won’t be visible on your credit report, and shouldn’t affect your score.

What happens at the end of my agreement?

What happens at the end of my agreement?

It depends on the type of finance.

Hire Purchase (HP): HP is designed to lead to car ownership. At the end of the agreement, if you want to own the car, you’ll need to pay a fee to cover the admin cost of transferring the car into your name - this is the Option to Purchase fee. It’s often around £100 - £200, but with Carmoola it’s just £1. Once this is paid, the car is yours!

Personal Contract Purchase (PCP): PCP is more flexible. When you get to the end of your agreement you can either pay the balloon payment, which covers the remaining value of the car, and become the car’s legal owner. This payment can often be a few thousand pounds. Alternatively, you can hand the car back to the lender and walk away. Or, you can use any positive equity you’ve built up as a deposit on a new PCP agreement on a new car.

Personal Contract Hire (PCH): PCH leases and car subscriptions don’t usually end with you owning the car. At the end of the term you hand the car back and walk away.

Personal loan: You’re technically the car’s legal owner from day one, and you’re free to do what you like with the car. When you’ve made all your repayments, the loan is paid off and is marked as completed on your credit report.

Does financing a car hurt your credit score?

Does financing a car hurt your credit score?

When you take out a new car loan, your credit score can take a dip, because you’re adding a new account to your credit report as well as a hard search.

But once you start making payments, your score should recover quickly. It could even improve over time if you pay on time every month. On the other hand, if you miss payments or default on the loan completely, your credit score may take a hit, and you might struggle to find finance again in the future.

Is it cheaper to finance a car or buy outright?

Is it cheaper to finance a car or buy outright?

It’s almost always cheaper to buy a car outright in cash rather than financing it. With no interest due, you’ll only be paying the car’s purchase price.

Of course, it’s not always possible to go down this route – and you might not want to.

If you buy a car outright, you’ll have to deal with its depreciation (loss of value over time) and the potential hassle of selling it in the future. If you choose a PCP car finance deal or lease instead, you could simply hand the car back.

Is it good to pay off a car finance agreement early?

Is it good to pay off a car finance agreement early?

If you have some extra cash available, you might be tempted to pay off your car finance agreement early. This can help you save money on future interest, but you may have to pay extra charges, known as early settlement fees, and this could offset these savings.

Who pays for repairs on finance cars?

Who pays for repairs on finance cars?

During the loan term of a car on finance, you’ll be its registered keeper and responsible for any repairs. Depending on the terms and conditions of your agreement, you might have to take the car to an approved garage.

Remember that extra charges can apply in a PCP or PCH agreement if you return a car that’s been damaged badly, so it might work out cheaper to get the repairs made yourself first.

How does 0% car finance work?

How does 0% car finance work?

0% car finance loans let you borrow the money to buy a new or used car without charging any interest. This type of loan is usually only available to people with good or excellent credit scores.

A word of warning, though - 0% loans are sometimes only available for a limited time, offered on cars with an inflated purchase price, or designed to encourage you to buy a car that’s considered otherwise undesirable. Extra admin charges can also apply.

Do you own the car if you’re on a finance agreement?

Do you own the car if you’re on a finance agreement?

With an HP, PCP, or PCH agreement, you won’t own the car during the loan term. Instead, you’ll be its registered keeper and responsible for its upkeep, road tax, insurance, and fuel. As you won’t be its legal owner, you can’t sell or modify the car without permission.

The exception to this rule is personal loans. In this case, you’ll become the car’s legal owner as soon as you pay the seller.

See how much you can borrow in 60 seconds

| Representative Example | |

|---|---|

| Loan amount | £10,000 |

| Interest rate | 13.9% APR |

| 54 payments of | £246 |

| Total cost of credit | £3,284 |

| Option to purchase fee | £1 |

| Total payable | £13,285 |

Related articles

Dealerships still dominate - but must adapt to shifting buyer expectations, report shows

New research* from Carmoola, the direct-to-consumer car finance lender, reveals a major shift in how UK consumers buy and finance...

PCP vs HP car finance: what's the difference and which is better?

When you're choosing between a PCP or HP car finance, the decision often depends on whether you prefer lower monthly payments or...

How to refinance your PCP balloon payment

Choosing to refinance a balloon payment on your PCP finance agreement replaces that intimidating lump sum with monthly payments....

.webp?width=832&height=592&name=customer-support%20(1).webp)

.webp?width=400&height=285&name=online-shoppers-with-dog%20(1).webp)

.jpg?width=500&height=356&name=Vintage%20car%20going%20to%20an%20old%20town-1%20(1).jpg)