- 🗞 Customers

- Last updated: Sep 30, 2025

- 4 Min Read

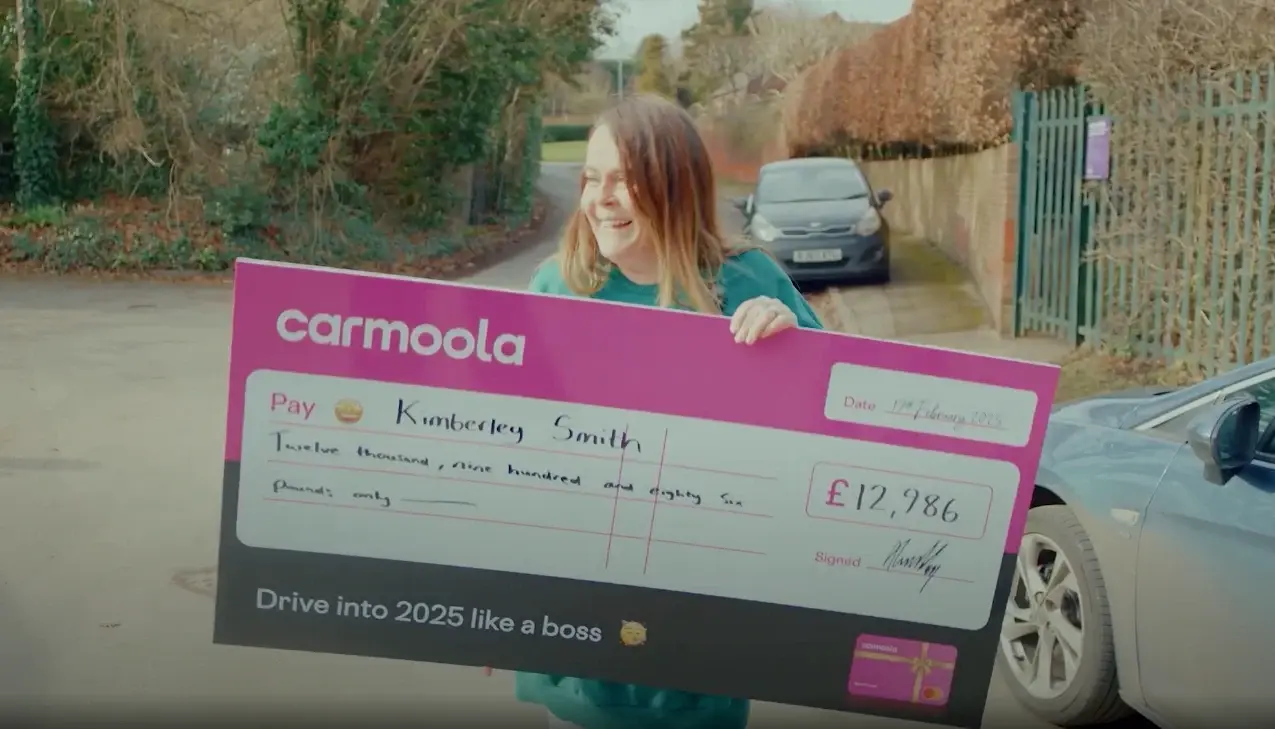

Kimberley’s car finance win that made a big difference

Written by

Verified by

See how much you can borrow in 60 seconds

| Representative Example | |

|---|---|

| Loan amount | £10,000 |

| Interest rate | 13.9% APR |

| 54 payments of | £246 |

| Total cost of credit | £3,284 |

| Option to purchase fee | £1 |

| Total payable | £13,285 |

Kimberley, who runs her own cleaning business, had her car loan paid off by Carmoola in our recent competition. Living in the countryside, northeast of Birmingham, driving is essential for her work and family life. In this candid conversation, she shares how she discovered Carmoola, what winning means to her, and how it’s changed things for the better.

Kimberley's comments reflect her own personal experience.

How did you find out about Carmoola?

Kimberley: “My husband. He’s like, oh, why don’t you try [Carmoola]? Well, that car’s literally on nearly 130,000 (miles). So I was like, well, I need a new work car.”

Is it just you in the car, or do you take your kids too?

Kimberley: “I take my daughter to college. To her boyfriend’s. But yeah, it’s my legs.”

And what did you think of Carmoola and the experience you had?

Kimberley: “You’re so different. Especially when I got the [customer welcome box], I was like, oh, isn’t that cute? I generally thought it was really cute. I got socks, obviously air fresheners, the bag, I’ve still got it all. I actually wear this (socks). You are different.”

Where did you get your car from?

Kimberley: “Castle Donington. About 40, 45 minutes. Because, you know, with everything going on with all the secret commission prices, they had me on that. I spoke to [my old finance company] and they even said, yeah, you’re part of the extra commission charges.”

How did that make you feel about the traditional lenders and dealers?

Kimberley: “Can I swear? [redacted] I thought you’re taking advantage, especially when people are struggling anyway. Especially when they know they need something.”

And is that part of why you wanted to use Carmoola?

Kimberley: “Yeah. I wanted to just get away from all that. Just try it. But yeah. Amazing. Super pleased.”

Kimberley’s story highlights the difference Carmoola can make, not just financially, but emotionally too.

From doubts at the start to the moment of receiving her giant cheque, she describes the experience in her own words: “I’ve never won anything in my life. I’ve got no words, just amazing. With everything going up, I could put a bit more on electric. A bit more on gas. Help pay the bills. Pay a bit more towards a bit more food shopping. So I’ll be able to splurge just that. Extra. Just a bit extra. Instead of getting normal toilet roll, I can get Andrex now.”

Watch the moment our CEO, Aidan, surprises Kimberley in our YouTube video.

All credit is subject to status and terms and conditions. Please borrow responsibly. This competition prize was a one-off promotion and is not part of Carmoola’s standard lending practices.

See how much you can borrow in 60 seconds

| Representative Example | |

|---|---|

| Loan amount | £10,000 |

| Interest rate | 13.9% APR |

| 54 payments of | £246 |

| Total cost of credit | £3,284 |

| Option to purchase fee | £1 |

| Total payable | £13,285 |

Related articles

Can you get car finance without a driving licence?

Yes, some lenders offer car finance without a driving licence, but Carmoola requires a full UK driving licence to complete an...

Dealerships still dominate - but must adapt to shifting buyer expectations, report shows

New research* from Carmoola, the direct-to-consumer car finance lender, reveals a major shift in how UK consumers buy and finance...

PCP vs HP car finance: what's the difference and which is better?

When you're choosing between a PCP or HP car finance, the decision often depends on whether you prefer lower monthly payments or...

.webp?width=832&height=592&name=customer-support%20(1).webp)

.webp?width=400&height=285&name=online-shoppers-with-dog%20(1).webp)

.jpg?width=500&height=356&name=Vintage%20car%20going%20to%20an%20old%20town-1%20(1).jpg)