Used car finance in Liverpool

Join Liverpool drivers who've already checked their car finance budget with Carmoola. No lengthy paperwork, no stress – just fast, fair deals.

Borrowing amount

Your monthly payments would be

- 🗓️ 48 month contract,

- 💰 £0 deposit,

- ✅ and an excellent credit score

For illustration purposes only. The rate and budget you may be offered will be based on your individual circumstances. This is not an offer or a quote for finance.

16293

drivers in Liverpool got their car finance budget

4.9

stars on Trustpilot

65+

approved dealers in Liverpool

#1

fastest growing car finance app

Easy car finance in Liverpool

No sales calls or lengthy paperwork. You only need our app, and a full driving licence.

See how much you can borrow

In just 60 seconds, get a budget for your next car – whether it's HP or PCP finance

Unlimited free car checks

Find your dream car, and make sure it’s shipshape. Usually £9.99 per check!

Buy your dream car

Add your Carmoola card to your wallet and tap to pay at the dealership

Give your car a name

Make it official – name your car and start your adventure with Carmoola

Find your next car in Liverpool

Your local car search just got smarter. Browse thousands of cars from approved dealerships and see what fits your budget.

Find my dream carAm I eligible for car finance in Liverpool?

To apply for car finance in Liverpool, you’ll need to be over 18, a UK resident for 3+ years, hold a UK driving licence, and be able to show proof of income if needed.

Best used car dealers in Liverpool

You can finance your next car with Carmoola at over 65 approved dealerships across Liverpool. From the city centre to Aigburth, Bootle, Wirral and beyond, you’ll find some of the best used car dealers in the region. And with more than 10727 dealerships accepting Carmoola across the UK, you're covered wherever your next adventure begins.

Top 5 car dealerships in Liverpool offering finance with Carmoola

Here are five top-rated used car dealerships in Liverpool, each known for great service and trusted cars:

Top 5 car dealerships in Liverpool offering finance with Carmoola

Here are five top-rated used car dealerships in Liverpool, each known for great service and trusted cars:

Allerton Motor Sales

559 Smithdown Road, Liverpool, Merseyside, L15 5AF

Beech Garage Car Sales Ltd

67 - 69 Bridge Road, Litherland, Liverpool, Merseyside, L21 2PA

Motorology

Kings Business Park, Kings Dr, Prescot, L34 1PJ

Georgesons Anfield

2-18 Breck Road, Liverpool, Merseyside, L4 2RA

Motor Range Liverpool

Dunnings Bridge Road, Bootle, Merseyside, L30 6YW

Browse our full list of Carmoola-approved dealerships in Liverpool

Browse dealershipsCarmoola is not directly affiliated with any of these companies

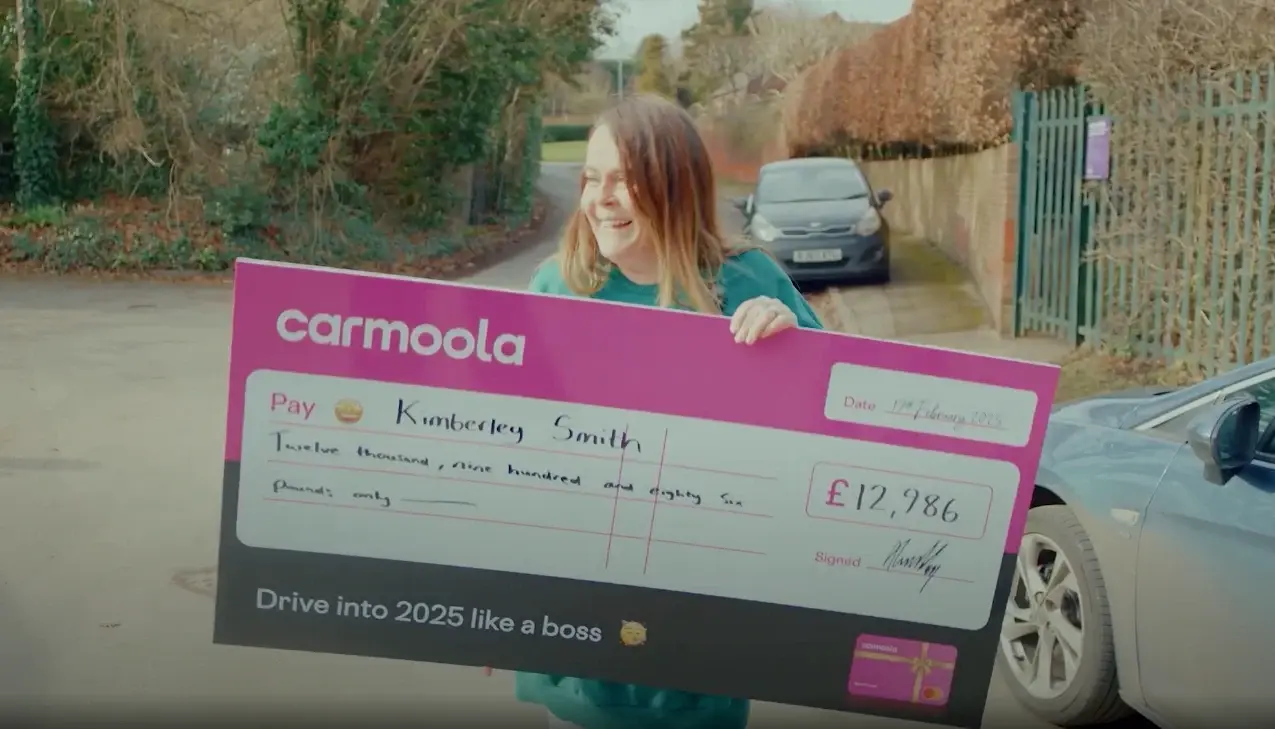

Real Liverpool drivers. Real stories

From city commutes to coastal drives, see how real Liverpool drivers financed their cars with Carmoola. Their words, their journeys, their keys in hand.

Car finance examples in Liverpool

Wondering how much car finance in Liverpool might cost you? We’ve crunched the numbers on a Ford Fiesta (one of the most popular used cars in Liverpool!) to show you real APR examples. From HP to PCP and even refinancing, here’s how it could look with Carmoola.

Borrowing £10,000 over 54 months with a representative APR of 13.9%, an annual interest rate of 13.9% (Fixed) and a deposit of £0, the amount payable would be £246 per month, with a total cost of credit of £3,284 and a total amount payable of £13,285, including a one-off Option to Purchase fee of £1.

Borrowing £10,000 over 48 months with a representative APR of 13.9%, an annual interest rate of 13.9% (Fixed) and a deposit of £0, the amount payable would be £208 for 47 months, followed by an optional final payment of £4,001. The total cost of credit would be £3,776, and the total amount payable would be £13,777, including a one-off Option to Purchase fee of £1.

Borrowing £10,000 over 54 months with a representative APR of 13.9%, an annual interest rate of 13.9% (Fixed) and a deposit of £0, the amount payable would be £246 per month, with a total cost of credit of £3,284 and a total amount payable of £13,285, including a one-off Option to Purchase fee of £1.

Car finance in Liverpool FAQs

Check below for the answers to some of our most frequently asked questions about car finance in Liverpool and driving around. Got more questions? Head over to our FAQs page 👍

What do I need to apply for car finance in Liverpool?

Applying for car finance in Liverpool is quick and fully online with Carmoola. You’ll just need to answer a few simple questions in our app. We’ll run a soft credit check to confirm your eligibility, but it won’t affect your credit score.

Here’s what we’ll need from you:

- Your full name and date of birth

- Your address in Liverpool and how long you’ve lived there

- Your employment status and income before tax

- How much do you want to borrow

To finish your application, you’ll also need to upload:

- Proof of ID – like a UK driving licence

- Proof of income – like bank statements

We offer UK-wide car finance. So, whether you’re based in Wavertree or Kirkby, you can apply anytime, anywhere. To get started, Get A Budget!

Can you get car finance with zero deposit in Liverpool?

Yes, you can get used car finance with no deposit in Liverpool, especially with HP car finance (Hire Purchase). For PCP car finance (Personal Contract Purchase), a 10% deposit is more common to reduce monthly repayments. Higher-value cars may be harder to finance with £0 upfront, but there are plenty of affordable options out there. Approval depends on the car’s make, model and price, and your eligibility.

Can I get car finance without a credit check in Liverpool?

No, every car finance application in the UK requires a credit check. You might see ads for no credit check car finance online, but here’s the deal: all regulated lenders must carry out at least a soft credit check to assess your eligibility. It won’t affect your score, but it helps make sure any offer is fair and affordable. However, we'll run a full credit check, or 'hard credit search' if you choose to sign your Carmoola agreement, which may impact your credit profile.

Can I get car finance with bad credit in Liverpool?

Yes, you might be able to get car finance with bad credit (low credit score) in Liverpool. The amount you can borrow with a poor credit score varies by lender. It might be less than if you had good credit, and the interest rates may be higher. Providing a larger deposit or having a guarantor could increase the amount you're eligible to borrow.

As a lender, Carmoola will look at your full financial picture. If we can’t help right now, we may be able to refer you to one of our trusted partners who might be able to. In those cases where we can’t offer finance ourselves, Carmoola will act as a credit broker.

Can I get a car on finance if I'm unemployed in Liverpool?

Being unemployed doesn’t automatically mean you won’t qualify for car finance in Liverpool. However, lenders like Carmoola will need to see proof of income, such as benefits or self-employment earnings.

And more

happy drivers across the UK 👋

I’m loving my new car life 🚗

Angelina Range Rover Evoque

Amazing efficiency and a professional way of financing. The paperless system is the top notch.

Biliat Range Rover Evoque

I bought my very own first car using Carmoola. They helped me out so much with the whole process.

Bethany Fiat 500

Easy to join. Thanks Carmoola, my dream has come true.

HoJing Toyota GT86

Carmoola is just the best, everything happened in minutes and their staff are simply the best. They made my experience perfect.

Kudzanai DS 3

Outstanding help and support

Got a question? Our friendly, UK-based team is here from

8am - 9pm EVERY day, via WhatsApp, email, SMS or phone.

.webp?width=832&height=592&name=customer-support%20(1).webp)

.webp?width=400&height=285&name=online-shoppers-with-dog%20(1).webp)

.jpg?width=500&height=356&name=Vintage%20car%20going%20to%20an%20old%20town-1%20(1).jpg)