Used car finance in Birmingham

Join Birmingham drivers who've already checked their car finance budget with Carmoola. Get approved for car finance in just 60 seconds with zero impact on your credit score to apply.

Borrowing amount

Your monthly payments would be

- 🗓️ 48 month contract,

- 💰 £0 deposit,

- ✅ and an excellent credit score

For illustration purposes only. The rate and budget you may be offered will be based on your individual circumstances. This is not an offer or a quote for finance. Rates from as low as 6.9% APR, Representative 13.9% APR.

28652

drivers in Birmingham got their car finance budget

4.9

stars on Trustpilot

271+

car dealers in Birmingham

#1

fastest growing car finance app

Easy car finance in Birmingham

No sales calls or lengthy paperwork. You only need our app, and a full driving licence.

See how much you can borrow

In just 60 seconds, get a budget for your next car – whether it's HP or PCP finance

Unlimited free car checks

Find your dream car, and make sure it’s shipshape. Usually £9.99 per check!

Buy your dream car

Add your Carmoola card to your wallet and tap to pay at the dealership

Give your car a name

Make it official – name your car and start your adventure with Carmoola

Find your next car in Birmingham

Your local car search just got smarter. Browse thousands of cars from dealerships and see what fits your budget.

Find my dream carAm I eligible for car finance in Birmingham?

To apply for car finance in Birmingham, you’ll need to be over 18, a UK resident for 3+ years, hold a UK driving licence, and be able to show proof of income if needed.

Best used car dealers in Birmingham

You can finance your next car with Carmoola at over 271 dealerships across Birmingham and the West Midlands. From Birmingham city centre to Solihull, Walsall, Dudley and beyond, you’ll find some of the best used car dealers in the region. And with more than 10727 dealerships accepting Carmoola across the UK, you’re covered wherever the road takes you.

Top 5 car dealerships in Birmingham offering finance with Carmoola

Here are five top-rated used car dealerships in Birmingham, each known for great service and trusted cars:

Top 5 car dealerships in Birmingham offering finance with Carmoola

Here are five top-rated used car dealerships in Birmingham, each known for great service and trusted cars:

Car Supermarket Birmingham

Mackadown Lane, Birmingham, West Midlands, B33 0JJ

United Traders Limited

United Traders, Amington Rd, Birmingham, B25 8EL

Your Car Supermarket

Unit 12, Ace Business Park Kitts Green Birmingham West Midlands, B33 0LD

GP Car Sales

101 Lower High St, Cradley Heath, B64 5AB

Scott Motor Company Ltd

65 Fazeley Road, Tamworth, Staffordshire, B78 3JN

Browse our full list of dealerships in Birmingham

Browse dealershipsCarmoola is not directly affiliated with any of these companies

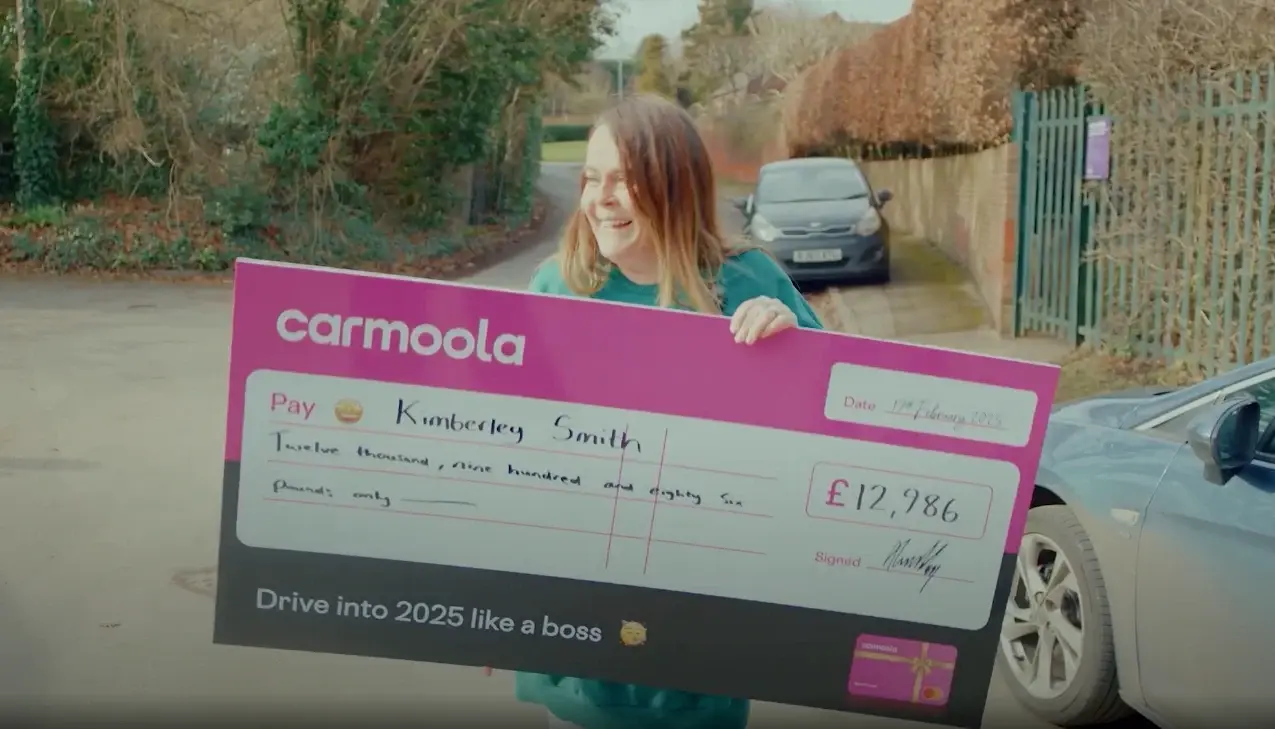

Real Brummies. Real Stories

From city commutes to countryside drives, see how real Birmingham drivers

financed their cars with Carmoola. Their words, their journeys, their keys in hand.

Car finance examples in Birmingham

Wondering how much car finance in Birmingham might cost you? We’ve crunched the numbers on a Ford Fiesta (one of the most popular used cars in Birmingham!) to show you real APR examples. From HP to PCP and even refinancing, here’s how it could look with Carmoola.

Borrowing £10,000 over 54 months with a representative APR of 13.9%, an annual interest rate of 13.9% (Fixed) and a deposit of £0, the amount payable would be £246 per month, with a total cost of credit of £3,284 and a total amount payable of £13,285, including a one-off Option to Purchase fee of £1.

Borrowing £10,000 over 48 months with a representative APR of 13.9%, an annual interest rate of 13.9% (Fixed) and a deposit of £0, the amount payable would be £208 for 47 months, followed by an optional final payment of £4,001. The total cost of credit would be £3,776, and the total amount payable would be £13,777, including a one-off Option to Purchase fee of £1.

Borrowing £10,000 over 54 months with a representative APR of 13.9%, an annual interest rate of 13.9% (Fixed) and a deposit of £0, the amount payable would be £246 per month, with a total cost of credit of £3,284 and a total amount payable of £13,285, including a one-off Option to Purchase fee of £1.

Car finance in Birmingham FAQs

Check below for the answers to some of our most frequently asked questions about car finance in Birmingham and driving around. Got more questions? Head over to our FAQs page 👍

What do I need to apply for car finance in Birmingham?

Applying for car finance in Birmingham is quick and fully online with Carmoola. You’ll just need to answer a few simple questions in our app. We’ll run a soft credit check to confirm your eligibility, but it won’t affect your credit score.

Here’s what we’ll need from you:

- Your full name and date of birth

- Your address in Birmingham and how long you’ve lived there

- Your employment status and income before tax

- How much do you want to borrow

To finish your application, you’ll also need to upload:

- Proof of ID – like a UK driving licence

- Proof of income – like bank statements

We offer UK-wide car finance. So, whether you’re based in Selly Oak or Sutton Coldfield, you can apply anytime, anywhere. To get started, get a budget!

Can you get car finance with zero deposit in Birmingham?

Yes, you can get used car finance with no deposit in Birmingham, especially with HP car finance (Hire Purchase). For PCP car finance (Personal Contract Purchase), a 10% deposit is more common to reduce monthly repayments. Higher-value cars may be harder to finance with £0 upfront, but there are plenty of affordable options out there. Approval depends on the car’s make, model and price, and your eligibility.

Can I get car finance without a credit check in Birmingham?

No, every car finance application in the UK requires a credit check. You might see ads for no credit check car finance online, but here’s the deal: all regulated lenders must carry out at least a soft credit check to assess your eligibility. It won’t affect your score, but it helps make sure any offer is fair and affordable. However, we'll run a full credit check, or 'hard credit search' if you choose to sign your Carmoola agreement, which may impact your credit profile.

Can I get car finance with bad credit in Birmingham?

Yes, you might still be eligible for car finance in Birmingham even with bad credit (low credit score). The amount you can borrow with a poor credit score varies by lender. It might be less than if you had good credit, and the interest rates may be higher. Providing a larger deposit or having a guarantor could increase the amount you're eligible to borrow.

As a lender, Carmoola will look at your full financial picture. If we can’t help right now, we may be able to refer you to one of our trusted partners who might be able to. In those cases where we can’t offer finance ourselves, Carmoola will act as a credit broker.

Can I get a car on finance if I'm unemployed in Birmingham?

Possibly, being unemployed doesn’t automatically mean you won’t qualify for car finance. However, lenders like Carmoola will need to see proof of income, such as benefits or self-employment earnings.

Is Birmingham easy to drive in?

Birmingham can be a bit tricky to navigate, especially during rush hour. Traffic can be heavy, and parking can be limited in some areas. However, the city has a decent road network and several major highways. If you're planning to drive in Birmingham, it's a good idea to use a satnav, leave longer for your journeys just in case and be prepared for congestion.

Can you get around Birmingham without a car?

Absolutely! Birmingham has an excellent public transportation system, including buses, trams, and trains. You can also use ride-hailing apps like Uber or Bolt for convenient transportation options. Additionally, Birmingham is a walkable city, with many attractions and amenities within walking distance.

Is there a charge to drive in Birmingham?

Yes, charges apply to certain vehicle types in Birmingham's Clean Air Zone. The zone is active 24 hours a day, seven days a week and covers an area of the city centre within the A4540 Middleway. You can find out more about whether your vehicle is exempt or not by using the following tool from the government: https://www.gov.uk/clean-air-zones

And more

happy drivers across the UK 👋

I’m loving my new car life 🚗

Angelina Range Rover Evoque

Amazing efficiency and a professional way of financing. The paperless system is the top notch.

Biliat Range Rover Evoque

I bought my very own first car using Carmoola. They helped me out so much with the whole process.

Bethany Fiat 500

Easy to join. Thanks Carmoola, my dream has come true.

HoJing Toyota GT86

Carmoola is just the best, everything happened in minutes and their staff are simply the best. They made my experience perfect.

Kudzanai DS 3

Outstanding help and support

Got a question? Our friendly, UK-based team is here from

8am - 9pm EVERY day, via WhatsApp, email, SMS or phone.

.webp?width=832&height=592&name=customer-support%20(1).webp)

.webp?width=400&height=285&name=online-shoppers-with-dog%20(1).webp)

.jpg?width=500&height=356&name=Vintage%20car%20going%20to%20an%20old%20town-1%20(1).jpg)